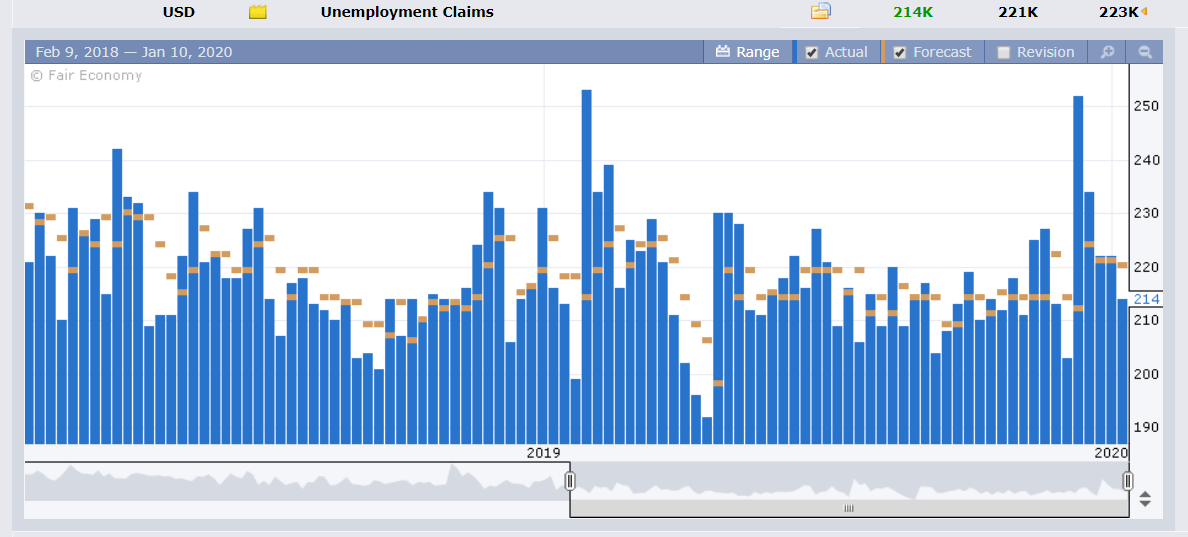

Summary: The Dollar extended its gains across the board in calmer markets ahead of the release of the US December Employment report. Markets are expecting a mixed Payrolls number for the first of the year and decade. FX expects the Fed to keep the same decidedly neutral stance until later in the year. Meantime, US Weekly Unemployment Claims decreased to their lowest level in 5 weeks to 214,000 from 223,000. The Dollar Index (USD/DXY) continued its climb, finishing at 97.43 (97.31), a gain of 0.13%. Against the Yen, the Greenback was up 0.41% to 109.48. The Euro ended at 1.1105, little-changed from 1.1107. Germany’s December Industrial Production beat forecasts, climbing 1.1% against 0.9%. Sterling fell to 1.3058 (1.3100) after BOE Governor Mark Carney said the central bank had room to ease. The Australian Dollar remained weak, slipping 0.35% against the US Dollar to 0.6852 despite a better-than-expected trade surplus.

Equity markets shrugged off the downing of a Ukrainian plane by an Iranian missile. Investors had suspected this. The easing Middle East tensions and trade optimism boosted Wall Street stocks

The Dow rose 0.78% to 28,815 (28,605). The S&P 500 was up 0.67% to 3,260 (3,240).

US bond yields were lower due to a successful 30-year treasury auction. The 10-year US bond yield dipped two basis points to 1.85%.

Australia’s Trade Surplus in December beat forecasts with an increase to +AUD 5.8 billion (vs +AUD 4.10 billion). Canada’s Building Permits underwhelmed, falling 2.4% against a forecast rise of 1.0%.

- EUR/USD – The shared currency rallied following the upbeat German Industrial Production report to 1.11204 but fell to 1.1093 on broad-based US Dollar buying. EUR/USD closed little changed at 1.1107.

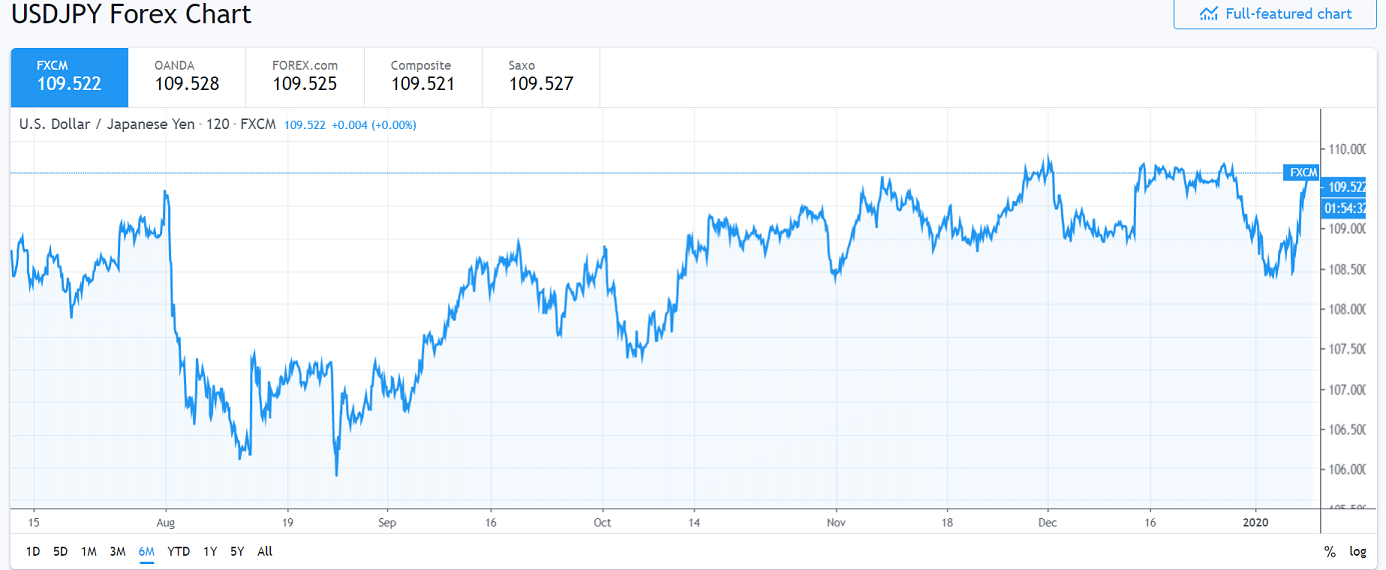

- USD/JPY – The Dollar remained steady against the Yen, finishing at 109.48, up 0.41%. Decreasing US-Iran tensions and a generally stronger Greenback lifted this currency pair.

- GBP/USD – Sterling slipped toward the 1.30 psychological level trading to an overnight low at 1.30132 before bouncing to settle at 1.3057, down 0.39% from 1.3100 yesterday. Dovish comments by BOE head Mark Carney weighed on the British currency.

- AUD/USD – The Aussie Battler was on the defensive slipping to 0.6850 from 0.6870 as more predictions emerged that the ongoing bushfire crisis would take its toll on the Australian economy.

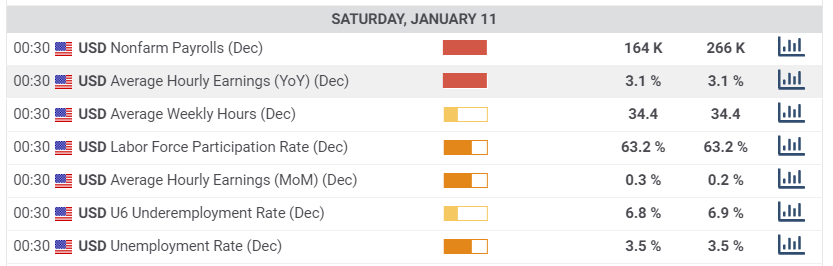

On the Lookout: It’s all about the Payrolls tonight. FX expectations are for a mixed US December Employment report. The upbeat ADP Private Employment and Weekly Unemployment Claims report support a good Payrolls number. The disappointing fall in ISM factory and services reports run counter to this and contribute to the mixed expectations. The conclusion is that the Fed remains the same. That said, any big diversions from the number will provide some good short-term trading opportunities. Markets will continue to monitor developments in the Middle East and on trade.

Australian AIG Services Index and December Retail Sales kick off today’s reports. Japanese Household Spending follows. European data start off with Switzerland’s Unemployment Rate, followed by French Industrial Production. Canada reports its Employment Change, and Unemployment Rate. US December NFP Employment, Average Weekly Earnings (Wages), and Unemployment Rate as well as Wholesale Inventories round up the day’s reports.

Trading Perspective: Politics aside, provided there are no new fireworks in the Middle East or on trade, its all about the Payrolls. Markets are focussed on a median increase of 164,000 jobs created from November’s 266,000. The Unemployment rate is expected to stay at 3.5%. Wages are forecast to climb to 0.3% from 0.2%. Which gives us a range on the Payrolls number between 135,000 to 200,000. A drop to 135,000 and the Greenback will be sold across the board. If the Payrolls increase is above 200,000 the Dollar will jump. Watch the Wages number too, that could be a mover if Payrolls come out near expectations. Get your levels sorted and keep them in mind. And don’t forget about market positioning (yesterday’s report).

- EUR/USD – The Euro traded in a calm and relatively narrow range between 1.1093 and 1.1120, closing little changed at 1.1107. Immediate resistance can be found at 1.1120 followed by 1.1150. Immediate support lies at 1.1085 followed by 1.1055. Prior to the Payrolls report, expect a likely trading range of 1.1090-1.1120. Prefer to buy on dips, the speculative market is still short of Euro.

- USD/JPY – The Dollar maintained its steady rise against the haven Yen, climbing to 109.50 at the close. Immediate resistance lies at 109.60 (overnight high traded was 109.58). The next resistance level can be found at 109.90. Immediate support lies at 109.20 followed by 109.00 (overnight low 109.013). The Yen has been the volatile currency given the geopolitical tensions that have risen this week. Any escalation on that should see a slump in the Dollar. For now, look to trade a likely range of 109.10-60. Prefer to sell rallies.

- AUD/USD – The Aussie Battler has gone from bid to offered in the course of this week. Australian economic data has outperformed on a few fronts, but bushfire crisis and overall stronger US Dollar is weighing on the Aussie. AUD/USD has immediate support at 0.6850 and 0.6820. Immediate resistance can be found at 0.6880 (overnight high 0.68804) and 0.6900. Look for a likely trading range today of 0.6850-0.6900. Prefer to buy dips, the speculative market is short, and the effects of the bushfire crisis is too early to determine.

Happy Friday and trading all.