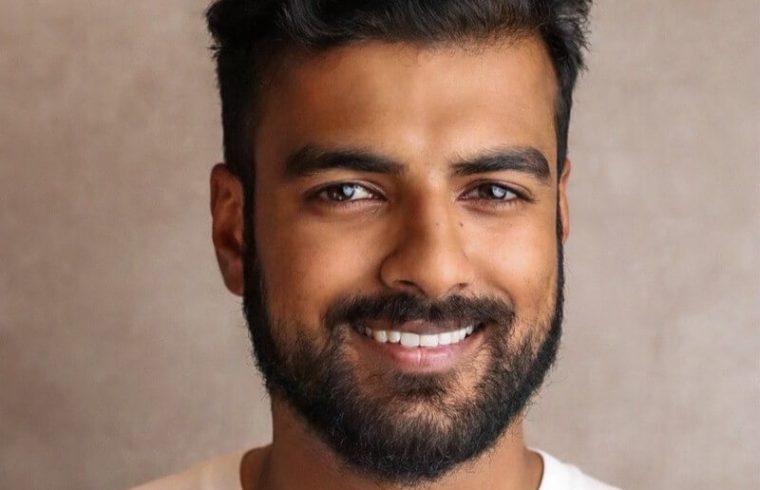

DKK Partners has announced Zain Abbas as its new Head of Product to spearhead the development and innovation of its tailored FX services.

The provider of emerging markets (EM) and foreign exchange (FX) liquidity aims to leverage the skills of Zain Abbas to further build DKK Partners’ product function and better serve Africa and the Middle East, among other emerging markets.

As Head of Product, Zain Abbas will continue DKK’s mission to support and empower organizations in frontier markets that are struggling against fragmented financial ecosystems, and which have limited access to global FX.

Zain Abbas joins DKK Partners after Thought Machine and IFX Payments

Before joining DKK Partners, Abbas held significant positions at Thought Machine and IFX Payments, and also served as a Local Councillor for the Royal Borough of Kingston upon Thames.

At Thought Machine, a London-based fintech unicorn known for its cloud-native core banking platform ‘Vault Core,’ Abbas served as a Client Delivery Manager from April 2022 to August 2023. In this role, he managed the full project life-cycle for client implementations, involving teams of up to six and budgets of up to £500,000. His projects ranged from developing innovative banking products, such as a buy-now-pay-later card product and a multi-currency wallet, to refining and implementing banking solutions for tier 1 banks across Europe. Abbas played a pivotal role in building strategic partnerships and developing financial products that integrate seamlessly with Thought Machine’s Vault Core, providing both commercial and technical coordination with third-party service providers.

Before Thought Machine, Abbas was an Implementation Manager at IFX Payments from November 2018 to September 2020, where he oversaw the implementation of the fintech product ‘ibanq,’ a multi-currency virtual IBAN wallet. His efforts significantly contributed to the growth of IFX Payments’ fintech desk, with monthly revenues escalating from approximately £85,000 to £650,000 under his tenure. Abbas’ role involved complex API integration projects and direct collaboration with clients’ technology and operations teams, demonstrating his adeptness in navigating the payments and FX ecosystem.

Zains Abbas, Head of Product, DKK Partners comments: “I’m delighted to have joined DKK Partners at such a pivotal time in their growth journey. With the company making waves in the emerging markets and foreign liquidity landscape, I am looking forward to bringing my expertise and experience to help build the company and expand our product to serve emerging markets.”

Sheeraz Saleem, CTO of DKK Partners, added: “Welcome, Zain Abbas, our new Head of Product, whose FinTech expertise will ignite innovation, steering DKK Partners towards new heights of excellence.”

DKK Partners reported 226% growth in 2023

DKK Partners has recently reported revenue growth of 226% growth in 2023, with a Compound Annual Growth Rate (CAGR) of 150% and an EBITDA margin of 52%.

The provider of emerging markets (EM) and foreign exchange (FX) liquidity, which has ambitious expansion plans across several regions for 2024, pointed to DKK’s Ghana executive chairman Clifford Mettle as a key player in accelerating DKK’s growth and profitability.

Mettle’s role has been pivotal in accelerating DKK’s vision to establish a stronghold in the flourishing African market, bolstered by securing the CONSUMAF license to better serve the central West African region.

In 2023 DKK opened offices around the world including Dubai where the company was recently granted initial approval from the Virtual Assets Regulatory Authority of Dubai (VARA) to offer Virtual Asset Broker Dealer Services. DKK currently operates in nine markets including Ghana, Dubai, Spain, and the UK.

DKK now plans to build on last year’s growth, eyeing new offices in Tanzania, Uganda, and Rwanda with obtaining new licenses to further boost compliance and scale ahead of a Series B fundraising round.