FinanceFeeds is excited to announce an exclusive interview with Aleksander Bobrov, the Head of Development at Colibrix, delving deep into the payment firm’s recent advancements and strategic positioning in the Latin American (LATAM) market.

Founded in 2020, Colibrix is a UK-based fintech company specializing in providing a broad range of payment solutions. As an FCA-authorized Electronic Money Institution (EMI), Colibrix offers services that include global card processing, digital wallet operations, and cross-border merchant accounts. The company supports multiple Alternative Payment Methods (APMs) and offers services like mass payouts and flexible settlements.

A few months ago, Colibrix became a Mastercard Principal Member, which enhanced its capability to offer better service and security in its transactions. The firm initially started as Paysage.io but rebranded to Colibrix in 2022. Well-established in Europe, the company has been expanding its presence into the LATAM, Australia, and APAC.

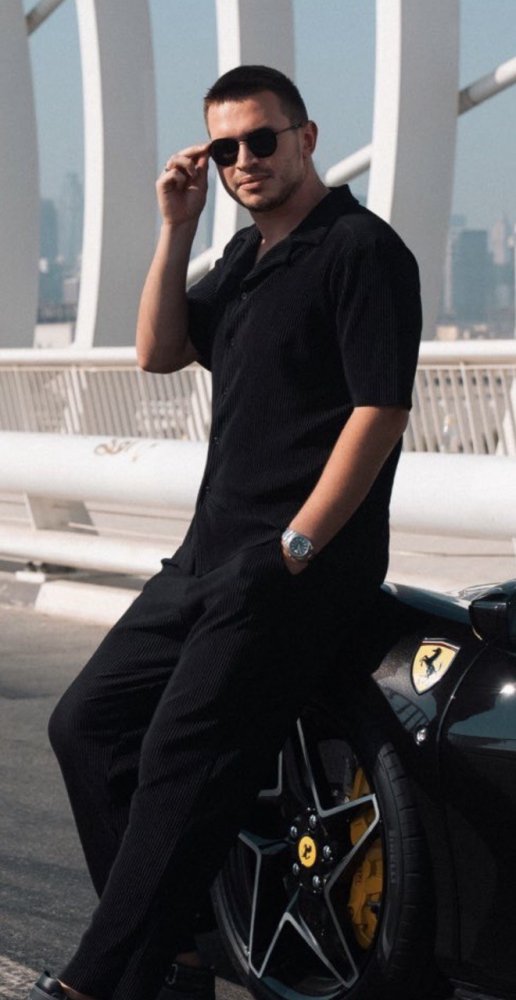

With us is Aleksander Bobrov, who has been in the payments industry for many years now, with roles at Cardpay, Paydoo, and VIALET, among others. He has been Head of Business Development at Colibrix since May 2020. Four years is time enough to know a company inside out.

Could you share the journey of Colibrix from its inception in 2020 to becoming a Mastercard Principal Member in December 2023, and how this evolution shapes your strategy in the LATAM market?

COLIBRIX’s journey from its beginnings to today has been quite an adventure. We’ve been actively engaging in financial expos and events worldwide, connecting with industry players, and gaining valuable insights along the way. Also, we have a great portfolio of over 50+ merchants already. It has been a rewarding experience and I’m very proud of the partnerships we’ve created. On top of that, our ongoing expansion with new offices has surely bolstered our presence. As for our strategy in the LATAM market, we’re focused on adapting to the unique dynamics of each country to better serve our clients. We see LATAM as a region ripe with potential, and we’re committed to tapping into its vibrant markets and diverse cultural and regulatory environment. We’re very excited about the impact we can make in the new region. And COLIBRIX is already gearing up for SiGMA Americas this April – so don’t miss us there!

Considering the diverse economic and cultural landscape in LATAM, how does Colibrix tailor its payment solutions to meet the unique needs of businesses in different LATAM countries?

Flexibility is key at COLIBRIX, especially in a diverse region like LATAM. We understand the importance of tailoring our payment solutions to fit the specific needs of businesses across different countries in this very unique region. I think the only way to make it there is to truly be adaptable and responsive to the payment trends and needs of the merchants that are either interested in expanding in the region or the local ones. Information and data is the key. We are always closely attuned to market trends and customer feedback, and because of that, we’re able to continuously refine and improve our solutions. We don’t want to just provide payment services, our plan really is to build long-lasting partnerships based on trust and reliability, that’s what makes us stand out.

With the rise of advanced fraud techniques, such as deep fakes and other sophisticated methods, how does Colibrix approach fraud detection and prevention to ensure the security of transactions?

Fraud detection is a critical matter that we at COLIBRIX take very seriously. Our goal is to ensure secure transactions for our clients and their customers. We work with businesses from high-risk, to low risk, and from small to big, so the security of our platform is a top priority. We’re constantly on the lookout for new threats and vulnerabilities, utilizing advanced technology and data analysis. We employ a multi-layered approach to fraud detection, incorporating machine learning algorithms, behavioral analytics, and real-time monitoring to detect and prevent fraudulent activities. In my opinion, it’s the only way to build confidence and trust with our merchants.

LATAM countries have some of the highest crypto adoption rates. How well has Colibrix integrated crypto as a payment option?

We have been interested in the field of cryptocurrency for quite some time now. At the moment we are actually in the process of creating our own crypto solutions. We see cryptocurrency as a game-changer, offering new possibilities for cross-border transactions and financial inclusion in LATAM. Especially for businesses who work with us to tap into the area and reach customers who prefer alternative payment methods. Our goal is to provide seamless and secure cryptocurrency options that enhance the overall payment experience for both merchants and consumers in LATAM, and everywhere really.

In which LATAM countries is Colibrix operating and how should a broker approach geographical expansion in the region?

This is something that we would like to keep a secret before the biggest expo in the region, but what I can say is that we’ve got some big dreams for LATAM, and we’re not afraid to chase them. Sure, expanding into new territory comes with its fair share of challenges, but we’re not ones to back down from a challenge. For the brokers: it’s important to take a thoughtful approach, carefully considering factors like regulatory environment and market readiness. We’re taking things one step at a time, building strong relationships, and laying the groundwork for success. We’re excited about the possibilities that lie ahead, and we’re confident that our flexible payment solutions and commitment to innovation will set us apart in the region in multiple countries at a time.

About Aleksander Bobrov, CEO of COLIBRIX

Aleksander Bobrov is the CEO of COLIBRIX all-in-one payment service provider and an accomplished business leader with an outstanding track record of delivering excellent results. During his tenure, he has demonstrated the ability to identify strategic partners worldwide, and succeeded in expanding a company’s merchant portfolio, diversifying across various GEOs and industries from low to high-risk. With his strong leadership skills and strategic vision, he has been able to drive growth and profitability for the company in record times, as well as gaining a status of Principals of Mastercard in less than 2 years.