China exhibited the lowest volatility in terms of the rate of change, with the lowest maximum decrease recorded at approximately -4.12%. This stability is particularly noteworthy against the backdrop of a turbulent global economic scene.

In a global environment marked by escalating inflation, geopolitical discord, and a plethora of economic hurdles, the significance of foreign currency reserves in maintaining a nation’s economic stability cannot be overstated.

A recent analysis commissioned by FOREX.com, examining the foreign exchange reserves of 94 countries from Q1 2019 to Q2 2023, sheds light on the pivotal role these reserves play in the economic robustness of nations amid challenging times.

China amassed US$3.1 trillion in Q2 2023

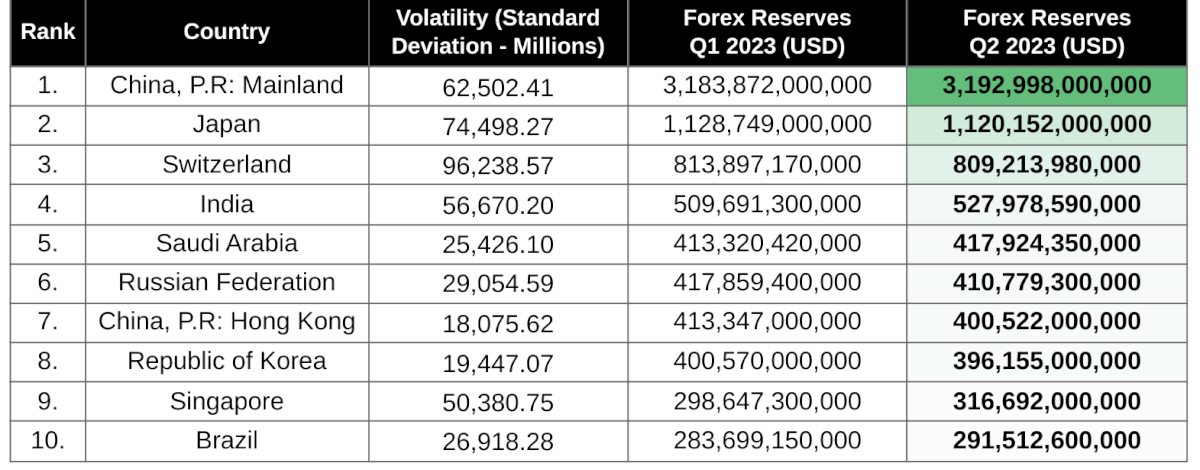

At the zenith, the People’s Republic of China (PRC) showcased the highest foreign exchange reserves in Q2 2023, amassing a remarkable $3.1 trillion USD ($3,192,998,000,000). Notably, China exhibited the lowest volatility in terms of the rate of change, with the lowest maximum decrease recorded at approximately -4.12%. This stability is particularly noteworthy against the backdrop of a turbulent global economic scene.

Japan, securing the second spot, held reserves tallying to $1.12 trillion USD ($1,120,152,000,000) in Q2 2023, outstripping the Republic of Korea (ROK) by a significant margin, nearly two-thirds to be precise. The juxtaposition of Japan and ROK underscores the disparate levels of forex reserves among nations, even in a region known for its economic vibrancy.

Switzerland, clinching the third position, held $809.2 billion USD ($809,213,980,000) in foreign exchange reserves in Q2 2023. However, it’s the high volatility, characterized by a standard deviation and a maximum increase of approximately 13.26%, that sets Switzerland apart. This high volatility is emblematic of the dynamic and oftentimes unpredictable nature of the foreign exchange reserves in response to global economic events.

The analysis further unveils the contrasting levels of forex reserves among other nations. For instance, the stark difference between the PRC and the Hong Kong Special Administrative Region (HKSAR) is evident, with HKSAR holding 87% less in foreign exchange reserves compared to the PRC. This disparity elucidates the varying economic buffer nations have amidst global economic uncertainties.

The communication from Wang Chunying, a spokesperson from the forex administration, highlights the interplay between global events such as the COVID-19 pandemic and monetary policy shifts in major countries, and the valuation of the US dollar, which in turn influences the trajectory of China’s foreign exchange reserves.

Moreover, the metrics driving Japan’s foreign exchange reserves, as reported by ministry officials, reflect the multifaceted factors affecting forex reserves, ranging from interest earned on foreign bond holdings, overseas yield declines, currency valuation shifts, to gold prices.

In the same vein, the Swiss National Bank’s (SNB) maneuvers through FX interventions during the eurozone debt crisis and the COVID-19 pandemic underscore the proactive steps nations take to mitigate appreciation pressures on their currencies, thereby impacting their forex reserves.

The analysis by FOREX.com provides a lucid view of the economic fortresses nations have, or lack, through their foreign exchange reserves in a period fraught with economic vicissitudes. It accentuates not just the economic disparities among nations, but also the diverse strategies and external factors influencing the ebb and flow of these crucial reserves.