Bitcoin is on the verge of a demand shock in the coming months, according to CoinShares’ Head of Research, James Butterfill.

With the recent approval of spot Bitcoin exchange-traded funds (ETFs), a massive influx of investments from Registered Investment Advisors (RIAs) is expected as the product becomes increasingly accessible to them.

Butterfill highlighted that RIAs, which manage assets valued at more than $50 trillion, often wait for three months of trading data before including a new instrument in their portfolios. This waiting period suggests that Bitcoin ETFs could soon see a wave of investments from RIA client. “If 10% of RIAs allocate just 1% of their portfolios, this could result in additional inflows of $50 billion,” Butterfill estimated.

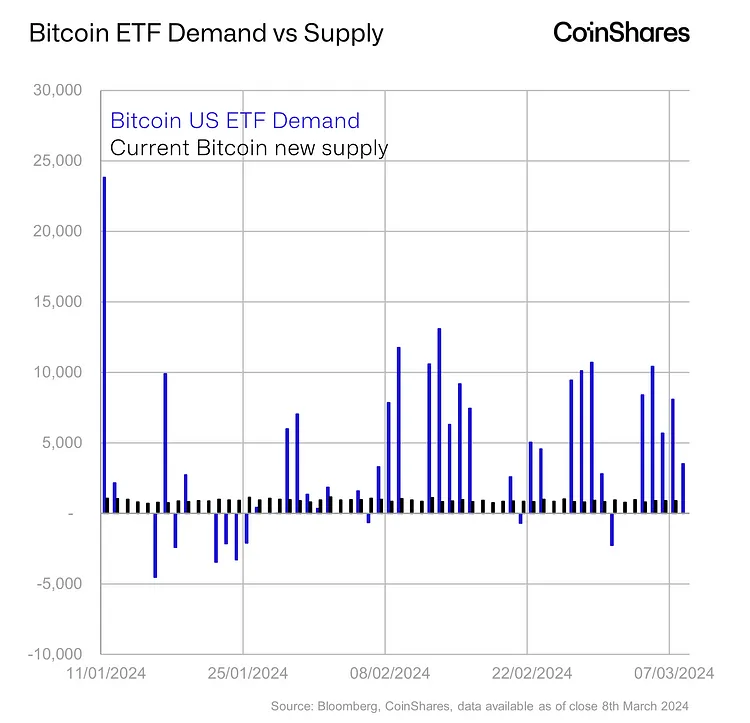

The demand for Bitcoin following the ETF approvals has already been decent, with an average of 4500 BTC exchange hands on a daily basis. The figure is way above the 921 bitcoins mined daily.

This imbalance has sparked a remarkable rally in bitcoin prices, as the fresh supply falls short of meeting the surging demand, pushing ETF issuers to dip into the secondary market for sourcing. Evidence of this shift is clear, with OTC desk coin holdings plummeting by 74% since their peak in 2020, likely a response to the escalating ETF demand.

The first two months post-ETF launch saw an explosive $10 billion flow into US ETFs, dwarfing the debut of iShares’ first Gold ETF in 2005, which saw $288 million in its first two months.

Butterfill also addressed the current pace of Bitcoin acquisitions, suggesting that it would take 573 days at the current daily rate of ~4500 BTC to exhaust the reserves of exchanges completely. However, he expects a gradual decrease in ETF inflows, which could help stabilize Bitcoin’s price.

Unlike the typical commodities market, which sees a supply response following a demand shock, Bitcoin’s immutable, capped supply presents a unique scenario.

Recent data supports the trend of large inflows into cryptocurrency investment products, with CoinShares reporting $2.92 billion in inflows from March 9 to March 15, following $2.69 billion in the previous period. Despite a brief interruption in the positive dynamic of net inflows into ETFs, with a $145.45 million outflow on March 18, the overall inflows since ETF approval reached $12 billion.