“One of the main challenges will arise from the unpredictability of FX exposures, particularly for asset managers with non-USD funds scattered across Asia. These firms will have to consider pre-funding – which involves setting aside cash to cover FX trades, primarily during liquid hours when spreads are tighter.”

Recent research from BidFX, an SGX company, highlights a significant issue in the foreign exchange (FX) trading market, particularly concerning the underutilization of the trading window between 4 pm and 6 pm Eastern Standard Time (EST).

The findings are particularly relevant for executives in the trading industry, as it sheds light on challenges related to liquidity and spreads in G10 currency pairs during these hours.

Key findings of the research

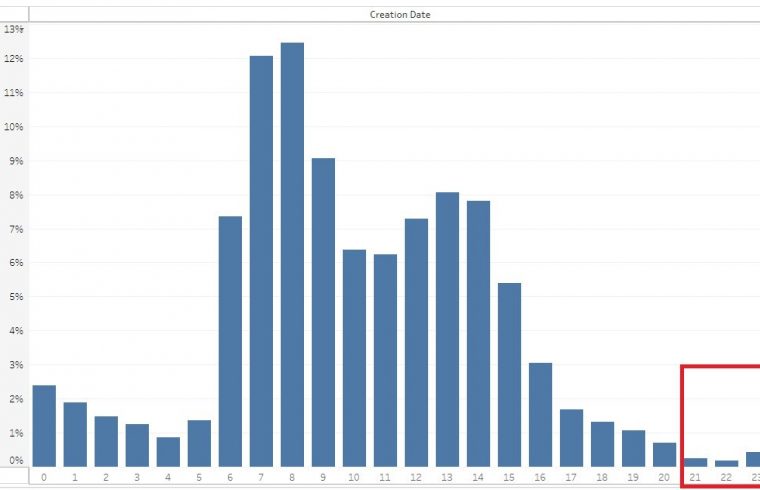

Low Trading Volume in the 4-6 pm EST Window: The data from BidFX shows that this time frame experiences less than 0.6% of the daily FX trading volume. This low level of activity leads to widened spreads and reduced liquidity, making it a challenging environment for traders.

Operational Challenges: One of the contributing factors to this underutilization is the restarting of pricing engines – the computer systems used for calculating real-time FX prices – which reduces the effective trading time. This procedural aspect is significant, as it restricts trading opportunities and impacts returns.

Impact of Global Market Timings: The near absence of open markets during the 4-6 pm EST window contributes to the lack of liquidity. With major financial hubs winding down, the trading environment during these hours becomes less attractive and more costly.

Implications for the Shift to T+1 Settlement: As the FX market moves towards T+1 settlement in May, the focus on linking FX trading to equities is intensifying, particularly during the 4-6 pm US trading session. This shift necessitates substantial operational changes to ensure faster confirmation and settlement of trades.

Investment banks’ FX pricing engines only restart at 5pm EST

Scott Gold, head of North American sales at BidFX, pointed out that the unpredictability of FX exposures, especially for asset managers with non-USD funds in Asia, is a significant challenge. These firms may need to consider pre-funding to cover FX trades during more liquid hours when spreads are tighter.

“The period between 4pm and 6pm Eastern time is particularly problematic, with liquidity constraints impacting spreads and depth of order book, in turn creating a tough environment for traders exposed to G10 currencies. There are very few markets open during these hours and the restart of investment banks’ FX pricing engines at 5pm creates a liquidity gap, making trading during this timeframe less attractive and more costly.

“One of the main challenges will arise from the unpredictability of FX exposures, particularly for asset managers with non-USD funds scattered across Asia. These firms will have to consider pre-funding – which involves setting aside cash to cover FX trades, primarily during liquid hours when spreads are tighter.”

The research underscores the importance of understanding and adapting to market dynamics, especially in light of upcoming changes in the settlement process. This knowledge can aid in navigating the challenges posed by the underutilized FX trading window and in capitalizing on potential opportunities in the evolving trading landscape.