Asian equity indices ended lower today as traders expect a 25 bps cut from the Fed to protect the economy from slowing growth and the effects of the trade tensions. Markets now put only about a 30% chance of another rate cut in December, compared with about 70% earlier this month. Rumours that a “phase one” deal might not be ready to be signed at the Asia-Pacific Economic Cooperation summit in Chile in November weigh on stocks.

On the Brexit front, the European Union agreed to UK’s request for a Brexit deadline extension but set no new departure date. Nikkei 225 ended 0.49% lower at 22, 861. The Hang Seng index is 0.25% lower at 26,718. The Shanghai Composite is 0.44% lower at 2,941. The ASX 200 in Australia is 0.54% lower at 6,709.

European indices started the day mixed, DAX trading 0.15% lower at 12,920. CAC40 is 0.14 per cent higher at 5,747, while the FTSE MIB in Milan is 0.08 per cent higher at 22,696. In London, FTSE 100 is trading 0.10% lower at 7,299.

In commodities markets, WTI crude oil trades 0.45 per cent lower at $55.29 as global growth worries weigh on crude. Brent oil is trading 0.28% lower at $61.06 per barrel as oil world supply will be affected by the global slowdown. Gold trades slightly lower at 1,488, as the short term momentum turns negative after the price trades below the 50-day moving average. On the upside, strong resistance stands at 1,555.13 yearly high while support is at 1,458 the recent low.

In cryptocurrencies, Bitcoin (BTCUSD) momentum is bullish, the cryptocurrency retreat today at 9,186, hitting the daily low at 9,175 and the daily high at 9,461. Bitcoin short term momentum is positive now as the cryptocurrency trades above the 50 and 200-day moving averages. First support for BTC stands now at $7,364 recent low, while next support stands at 7,300 round figure. On the upside, resistance now stands at 9,925 recent high and then at 10,000 round figure. Ethereum (ETHUSD) trades lower at 186,64 with capitalisation now to 20.18 billion, and on the upside, the immediate resistance stands at 200 recent high while the support stands at 136 the low from May 6th, LTCUSD trades slightly lower at 58.46. The crypto market cap capitalization now stands at $247.79 billion.

On the Lookout: US Pending Home Sales Index increased by 1.5% in September, topping market expectations of a 0.9% rise. The Conference Board consumer confidence drop to 125.9 in October, from a September reading of 126.3, while the S&P CoreLogic Case-Shiller 20 City Index dropped to 0.16% in August.

Australia HIA New Home Sales came in at 5.7%, below expectations of 33.7% in September. Australia Consumer Price Index (YoY) came in line with expectations at 1.7% in 3Q. Australia RBA Trimmed Mean CPI (YoY) came in at 1.6% as expected in 3Q.

Japan Retail Trade (YoY) came in at 9.1% topping expectations of 6.9% in September while Japan Large Retailers’ Sales came in at 10% beating expectations of -1.7% in September.

The central bank of China set the Yuan rate (USDCNH) at 7.0582 versus yesterday settlement at 7.0617.

Trading Perspective: In fx markets, USD index trades 0.01 per cent higher at 97.69, the AUDUSD trades 0.03 per cent lower at 0.6862, while NZDUSD trades 0.10% lower at 0.6349.

GBPUSD trades 0.01% higher at 1.2867 as we are getting closer to the Brexit deadline. Major support now stands at 1.2078 recent low which if broken, might accelerate the slide further towards 1.20. On the upside, immediate resistance now stands at 1.3010 recent high while more offers will emerge at 1.3050 round figure.

In Sterling futures markets open interest decreased by 5,700 contracts, volume decreased by around 5.500 contracts.

EURUSD trades 0.01% lower at 1.1111 as the pair’s momentum is bullish. Immediate resistance for the common currency stands at 1.1162 recent high. On the downside, first support stands at 1.1073 yesterday’s low and then at 1.1003 the previous week low.

In euro futures markets open interest increased by 1.600 contracts, the volume decreased by around 18.400 futures contracts.

USDJPY is trading 0.05% lower at 108.83 having hit the daily low at 108.80 and the daily high at 108.88. USDJPY pair will find support at 104.44 the low from August 23rd. On the upside, immediate resistance for the pair now stands at 109.06 recent high.

In Yen futures markets, open interest increased by 5,500 contracts, volume decreased by around 453 futures contracts.

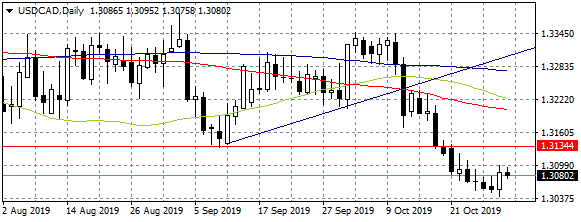

USDCAD is trading 0.05% higher at 1.3092 the pair will find immediate support at 1.3017 the YTD low while extra support stands at 1.30 round figure. On the upside, immediate resistance now stands at the 1.3356 high from September 3rd before an attempt to 1.3450 high from 31st May.