smartTrade Technologies, a leader in multi-asset electronic trading solutions, has added cryptocurrencies to its FX Trading Platform, LiquidityFX (LFX), which connects to major cryptocurrency exchanges.

The cryptocurrency market enjoys a market cap of approximately $383 billion and $18 billion traded in 24 hours – which is just under 5% of total capitalization – in over 10,000 markets. Trading volumes are concentrated in the top ten cryptocurrencies, which accounts for about 70% of daily turnover.

The current stage of the digital asset market keeps pricing relatively opaque and challenging when trading. smartTrade’s LiquidityFX helps cryptocurrency traders gain a better perspective of the market as it connects to a wide number of exchanges. Users are able to leverage the sophisticated LFX aggregation system to obtain a normalized view of the cryptocurrency liquidity. There, they can place orders and manage algorithms with Smart Order Routing (SOR) logic in a transparent manner.

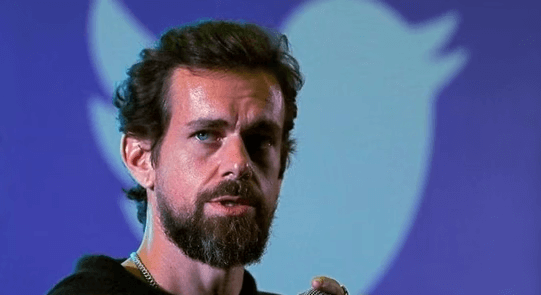

David Vincent, Chief Executive Officer at smartTrade Technologies, commented:

“Where inquiries and discussions in 2017 were mainly related to Bitcoin, we now start to see an increasing interest from institutions to be able to trade multiple cryptocurrencies. Therefore, we decided to explore and invest in connectivity to various Crypto Exchanges, providing our customers with electronic trading access to hundreds of different cryptocurrencies.”

LiquidityFX also features pricing engines, price distribution, auto-pricing and auto-hedging, order management, hosting and colocation as well as analytics and TCA. These functionalities are also available for cryptocurrencies.

In June 2017, Sucden Financial deployed smartTrade’s fully hosted FX solution LiquidityFX to leverage its expansion plans as it covers the broker’s needs for connectivity to multiple liquidity providers, aggregation, order routing, pricing and distribution as well as a fully integrated order management system.

Additionally, smartTrade’s LiquidityFX credit margin module allows Sucden’s end clients to trade larger amounts and leverage their cash margin while the broker monitors and manages their risk coverage in real time.