This week, the Chinese Central Bank (PBoC) approved a broad package of measures to get the ailing economy growing again. But it is not really an economic stimulus package, rather a support package for the struggling real estate market.

The Shanghai stock market celebrated the measures with the biggest gains in many years. Even our trading indicator ‘After Open Action’ was surprised by the announcement…

The Hong Kong stock market, which is now under Chinese control, also benefited. Here the ‘After Open Action’ worked perfectly…

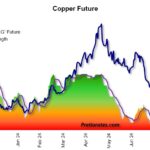

In the western hemisphere, many financial markets also reacted positively to the decisions of the Chinese central bank. The copper market, for example, reacted very positively…

However, it is being forgotten that construction activities in China are not picking up again immediately. The news was probably just the trigger for an upward movement that would have occurred anyway due to backwardation…

(Backwardation means that spot markets are trading higher than futures. This indicates that there is insufficient supply in the spot market).

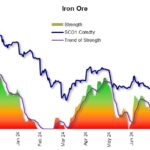

The iron ore market confirms that this week’s copper rise is only slightly related to the decision of the Chinese central bank. This should also have risen sharply if China were responsible for the rising sun… However, the iron ore market reacted with complete indifference…

The fact is that real estate has been a very poor investment for the Chinese in recent years. The stock market has also almost halved since its high at the beginning of 2021. But the central bank assistance primarily means support for existing real estate owners. And only 10 % of Chinese are invested in the stock market. So if it advances by over 15% in only one week, 90% of Chinese don’t care.

There are still enough empty apartments in China to meet demand for many years to come. A recovery is therefore not necessarily on the cards and it can therefore be assumed that construction activity in China is unlikely to pick up before a new upturn. As a result, this industry does not need any additional copper or iron ore – unlike a few years ago.

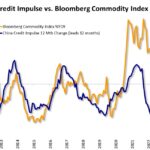

We therefore also have our doubts about how the credit impulses will affect the Chinese economy. In the past, credit impulses always had an effect on the commodity index about 12 months later. Logically: first finance, approve and then order the raw material… But hasn’t China already built enough?

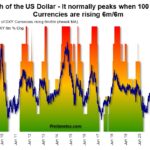

Where is the real action? We focused on the Japanese Yen throughout the spring. The action with the carry trades took place in August. Now we are interested in the US Dollar. We presented the following chart last week. It is alarming to see how its strength against other currencies is declining. Its strength fell from 83% to 17% within a month.

The US Dollar Index is on the verge of falling below the psychologically important 100 mark. The balance of power (strength between bulls and bears) continues to fall…

The development of the assets oft he European Central Bank (ECB) has a high correlation with the Euro, with a delay of around three months. And this indicates a rising Euro against the US Dollar in the coming weeks – which would be another negative sign for the greenback…

Since the beginning of 2023, it has remained in a relatively broad trading band between 100 and 106. The low of July 2023 at 99.60 could be subject to a further test. It is to be hoped that it will hold, because below it there is a great void…

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.