Gemini, the cryptocurrency exchange founded by the Winklevoss twins, has terminated its interest-bearing crypto product amid growing spat with crypto lender Genesis.

In the email sent to customers, Gemini said that it was wrapping up the Earn program in an attempt to force Genesis to repay the $900 million it owes the exchange’s clients. From a legal perspective, the action officially requires Digital Currency Group’s lending arm to return all outstanding assets to the two-year-old program, which promised customers yields of about 8%.

Gemini has also dissolved the master loan agreement put in place between Genesis and its 340,000 customers who participated in the yield-bearing product.

“We are writing to let you know that Gemini—acting as agent on your behalf—has terminated the Master Loan Agreement (MLA) between you and Genesis Global Capital, LLC (Genesis), effective as of January 8, 2023,” the email said.

The Winklevoss twins’ exchange stressed that “The return of your assets remains our highest priority and we continue to operate with the utmost urgency.”

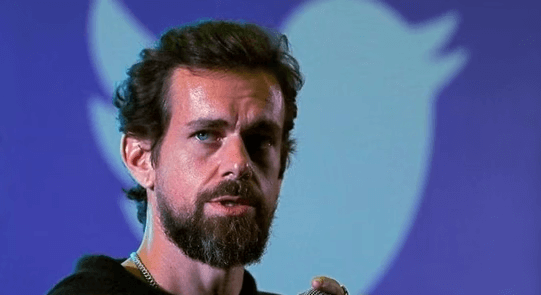

In a letter shared on Twitter, Gemini cofounder Cameron Winklevoss brushed off Digital Currency Group CEO Barry Silbert, accusing him of misrepresentation and accounting fraud. In a follow-up letter sent on Tuesday, he called for Silbert to step down.

DCG, the parent company of Genesis Global Trading, crypto app Luno, and media company Coindesk, hit back at the accusations. The firm called Winklevoss’ open letters “another desperate and unconstructive publicity stunt” designed to “deflect blame from himself and Gemini, who are solely responsible for operating Gemini Earn.”

DCG added that it would “preserve all legal remedies in response to the malicious, fake, and defamatory attacks.” Winklevoss also claims that DCG owes Genesis $1.675 billion, but the company’s CEO disputes that this figure is correct.

DCG did not borrow $1.675 billion from Genesis

DCG has never missed an interest payment to Genesis and is current on all loans outstanding; next loan maturity is May 2023

DCG delivered to Genesis and your advisors a proposal on December 29th and has not received any response

— Barry Silbert (@BarrySilbert) January 2, 2023

The lending unit of Gemini suspended redemptions and new loans in November due to the collapse of FTX crypto exchange. At the time, Gemini had reportedly experienced a $563 million rush in customer outflows in a single day, which was the largest in its history.

The move raised questions about the health of Gemin’s program that holds nearly $1 billion in customer money. The Earn accounts were frozen after its main lending partner, Genesis Global Capital, enacted a similar freeze.