Celebrating its 14th anniversary, Tools for Brokers (TFB), hosted a private networking event in Cyprus, gathering industry professionals to discuss future trends and innovations.

FinanceFeeds seized this opportunity to engage with Petros Kalaitzis, Head of TFB’s Cyprus office, uncovering insights into the firm’s latest corporate actions tool, distinctions between MT5 licensing options, the essentials of launching trading firms, and the industry’s varying adoption of automated processes.

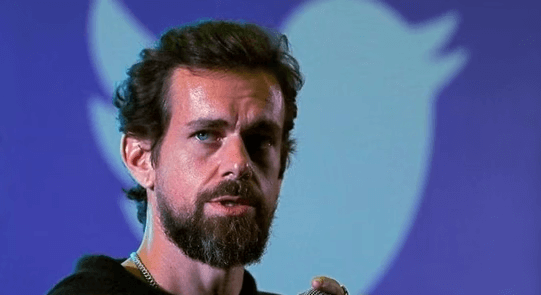

Petros Kalaitzis has been with Tools for Brokers since 2022 after more than a decade of experience in the brokerage industry, including pivotal roles in business development, operations, and client services at Tickmill and Saxo Bank. In his current role, Kalaitzis focuses on strengthening client relationships, driving growth in the EMEA region, and leading the Cyprus team towards achieving TFB’s strategic goals.

Tools for Brokers offers a suite of tools designed to enhance operational efficiency, risk management, and client engagement for forex brokers and hedge funds. The company’s products include trade execution software, risk management tools, and regulatory compliance solutions.

Corporate actions: Helping Forex brokers with dividend distribution

The Q&A session commenced with an insightful exploration into Tools for Brokers’ latest innovation: a corporate actions tool designed to revolutionize how forex brokers manage dividend distributions. Petros Kalaitzis highlighted its capability to automate the traditionally manual and error-prone process of corporate actions management and noted that it goes beyond dividends. “We’re developing a tool to automate all corporate actions, not just dividends. Instead of manually sourcing and adjusting dividends in client positions, our tools automate this process, reducing risks and saving resources.”

It was in 2022 that TFB first added its Corporate Actions tool to its platform. The automation tool helps MT4/5 brokers operate more efficiently by planning and automating actions such as dividend adjustments. For example, they can schedule automatic Corporate Actions including dividend adjustments for all open positions for a pre-defined list of trading instruments and client groups.

Main MT5 Label vs White MT5 Label

The interview also delved into the nuances between Main MT5 Label and White MT5 Label licensing. Petros Kalaitzis clarified that with a Main MT5 Label, brokers directly purchase and own the MetaQuotes platform license, enabling them to use TFB’s comprehensive maintenance and support services. On the other hand, a White MT5 Label does not offer license ownership but still provides similar levels of support. Following MetaQuotes’ directive, TFB now exclusively offers Main Label services, emphasizing the strategic value of holding a direct license with MetaQuotes for brokers.

With a Main Label, brokers get complete onboarding and support, a bridge solution, and built-in risk management tools. The solution provides a complete infrastructure for the broker to help them launch faster and grow exponentially. The Main Label can also be used for prop trading, allowing firms to diversify risks through multiple business models. With TFB’s Main Label, there are several tools that firms can apply to enhance their operations, such as the advanced StopOut solution, VWAP (volume-weighted average price) to fully immerse traders in the real-market simulation, and the A/B-risk tool for risk reduction.

Launching a prop firm or retail broker

Petros Kalaitzis discussed the foundational aspects of launching either a proprietary trading firm or a retail brokerage, highlighting the similarities and differences between the two: “There’s not a big difference between launching a prop firm or a retail brokerage; the core remains the same, including an execution engine and some automation. The main difference is regulatory requirements; prop firms currently don’t need a license. For both, TFB offers products related to execution, like our bridge and plugins, to minimize risks and automate procedures, crucial for the company’s core system.”

Indeed, TFB’s all-inclusive prop trading package allows firms to build and maintain demo environments that resemble real-life trading conditions. The package includes the MT5 platform, Trade Processor, bridge connection to LPs, orders for demo accounts, automation tools, data feed, hosting, affiliate systems, and a dedicated risk management tool for analyzing data.

Are brokers adopting automation?

To conclude, Kalaitzis addressed the varying pace at which brokers adopt automation, attributing differences to their developmental stages, available resources, and budgetary constraints. Despite these challenges, he observed a trend where even brokers with smaller revenues prioritize automation, particularly in dealing rooms, to mitigate risks and potentially save significant costs, underscoring automation’s growing importance across the industry. “Brokers progress differently; some are just starting, while others are more advanced. The reasons for varying levels of service use include staff availability and financial constraints. However, in recent years, even smaller revenue brokers are reallocating their budgets towards automation, especially in dealing rooms, to minimize risks and prevent financial losses.”

Tools for Brokers has been at the forefront of automation for brokers, hedge funds, and prop trading firms, for years. In a recent blog post, Albina Zhdanova from TFB enumerated the main benefits of automation: time-saving, risk reduction, and freedom to focus on strategic and creative tasks. As to results: cost efficiency, well-balanced workload, innovation, higher customer satisfaction rates.