Regardless of what we think of the intrinsic value of Bitcoin or other leading cryptocurrencies in the market, we all have to face it, they stood the test of time. The digital asset class came, saw, and conquered.

We are now left to take due action, whether it is to add digital asset trading to our portfolios or sit on the sidelines. But the bullish trends in the cryptocurrency markets in the APAC region are overwhelming. The whole ecosystem seems unstoppable with constant innovation and creative destruction. Even most government regulators don’t want to stifle the movement despite the (long shot) risk of it becoming a threat to current monetary systems.

If the whole point of the investment industry is to help properly allocate resources, manage risk, and create wealth, how can we not add crypto to our portfolios? Especially now that the asset class has grown to a market capitalization above the $1 trillion threshold, Tesla bought $1.5 billion in Bitcoin, and CME Group just launched Ether futures, further mainstreaming the asset class.

No wonder that established trading companies across the world, such as CMC Markets, are getting on board the crypto train: investor demand comes from both retail and institutional sides, the market is increasingly liquid and the regulatory framework is getting clearer by the day.

More than ever, traders want in on the action and multi-asset platforms are the obvious choice. CMC Markets Connect provides access to 10,000+ instruments across CFDs, and derivatives (incl. FX, indices, commodities, equities, and treasuries), with market depth and dedicated liquidity.

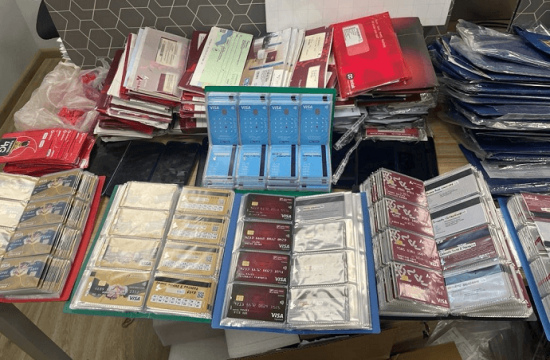

And, most of all, the number one concern for investors wanting in on the crypto bandwagon is the fear of hacking and scams like the ones we all saw throughout the years at Coincheck, Bithumb, and many more. That’s why traders look for an established brand and service within the trading industry rather than unregulated funky “cryptocurrency exchanges”.

Access to cryptocurrencies has become a deal-breaker for many choosing their next broker

As said above, cryptocurrencies are not going away. The pressure mounts and investors are looking for a safe and practical way of gaining exposure to the digital asset class. “Safe” translates to a regulated and established company within the trading industry. “Practical” means access to a user-friendly, multi-asset platform: a one-stop-shop to access cryptos plus other assets from a single account.

A 2020 study conducted by derivatives analysis firm Acuiti found that adoption rates from trading firms in the APAC region were the highest in the world, at 57%. The report also identified “a growing split between demand from traditional trading firms to broaden their coverage of digital assets and the willingness or ability of sell-side firms to provide access”.

This is 2021 and a lot has happened. Adoption rates in the Asia Pacific have surely grown further and CMC Markets Connect has arrived to address that demand.

CMC Connect comes as the ideal counterparty for its strong balance sheet, a solid history, and proper regulation. The platform ensures the most accurate crypto pricing by aggregating from 18 different feeds. Fast execution is offered over CMC’s best-in-class technology, minimizing slippage.

In addition, CMC leads the way in client-focused innovation, which helps drive product development. One example is the introduction of crypto-indices, which provide broader exposure thereby mitigate volatility and also offer reduced margin requirements. These are:

“Major” covering the four most established coins – Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

“Emerging” incorporating 7 coins including Dash, NEO, and TRON

“All” blending constituents of all sizes.

CMC’s crypto offering comprises of 14 cryptocurrencies quoted against the US Dollar, with margins starting from 5%.

Demand for access to cryptocurrency trading clearly outweighs the supply of that access. A solid crypto offering backed by an established player in the industry such as CMC Markets Connect is a key differentiator and even a deal-breaker for anyone choosing a broker nowadays.

Cryptocurrency Index Trading: https://assets.cmcmarkets.com/pdfs/Cryptocurrencyindextrading.pdf

Index Methodology: https://assets.cmcmarkets.com/pdfs/CMCMarketsTieredWeightCrypto.pdf

Cryptocurrencies Instrument Details: https://assets.cmcmarkets.com/pdfs/CryptocurrenciesInstrumentDetails.pdf

For more information on CMC Markets Connect crypto offering, please contact Head of Institutional – APAC, Andrew Wood at [email protected].