“It seems the SEC is throwing this DPP Hail Mary and hoping that Judge Torres bails them out on appeal”.

Ripple has filed a Letter Motion to Compel the SEC to turn over the “Estabrook Notes” regarding a 2018 meeting between Brad Garlinghouse and former Commissioner Roisman.

Like in other past disputes over SEC’s documents, the plaintiff refuses the produce them over claims of deliberative process privilege.

Elad Roisman left the SEC in late 2021 and was seen somewhat as a Ripple ally as only Roisman and Hester Peirce – 2 out of 5 SEC Commissioners – were critics of the SEC’s enforcement posture, called for regulatory clarity in the digital asset space and for a safer environment for innovators.

It seems that the SEC had learned of the Estabrook Notes only on January 11, 2022, when Mr. Estabrook, then-counsel of Elad Roisman, cleaned out his desk as he prepared to leave his position at the SEC.

The SEC is calling privilege, but Ripple thinks otherwise as under the court’s January 13, 2022 ruling, the Estabrook Notes are not privileged and should be disclosed.

Ripple refers to the Judge’s Netburn order to hand over a number of documents she considered not to be protected by DPP. That ruling, despite being “granted in part, denied in part”, was seen by attorney John Deaton as XRP holders’ “biggest victory”.

“Notes taken by SEC staff in the context of fact-gathering with third parties (i.e., not the SEC itself) do not fall within the scope of the DPP, even if the information gathered may later be relied on for future policymaking”, said Ripple in its motion to compel.

“As with the other notes this Court ordered the SEC to produce, there is no evidence that in the Estabrook Notes “certain facts were recorded while others were purposely omitted as an exercise of judgment or deliberation” or that such a decision was made to assist with agency decision-making.”

“SEC’s stated position, that the Estabrook Notes were taken for purposes of ultimately advising the Commission on policy, is exactly the same justification that the SEC gave for withholding notes of other meetings, and that the Court has already rejected.

“The fact that the SEC relies on information it learns when it makes policy does not make all of the information the SEC learned privileged”.

“Defendant Garlinghouse requests that the Court order the SEC to produce the Estabrook Notes or, alternatively, order the SEC to provide the document to the Court for in camera inspection.”

XRP community-friendly attorney Jeremy Hogan commented on the motion to compel, saying that it “seems the SEC is throwing this DPP Hail Mary and hoping that Judge Torres bails them out on appeal”.

He based his view on an email exchange between the SEC and Ripple over the production of said documents in which SEC’s Mark R. Sylvester, Esq. stated:

“As you conceded during our January 21, 2022 call, neither Mr. Roisman nor Mr. Estabrook participated in this meeting in connection with the investigation of Ripple”

“As seen below, the SEC has no tenable basis for raising the DP Privilege here since it conceded to Solomon that the notes cannot be related to the investigation of Ripple”, attorney Hogan said.

Ripple Labs has recently filed its Sur-Reply regarding the SEC’s Motion to Strike the Fair Notice Affirmative Defense to oppose “the SEC’s inappropriate request” for judicial notice and to address the SEC’s “misleading characterization of its prior enforcement actions”.

The SEC has previously asserted that Ripple’s fair notice defense “fails” because, “prior to suing Ripple, the SEC had already brought more than seventy cases that subjected other digital assets to the application of the

federal securities laws.”

The agency also cited the May 2021 report by Cornerstone Research distributed after Ripple filed its Opposition brief and requested the court to take judicial notice of the SEC complaints which the report characterizes as “cryptocurrency enforcement actions.

In response, Ripple stated that a “sur-reply is amply justified here” in order to tackle “the SEC’s inappropriately premature request for this Court to conclude, as a factual matter, that market participants had fair notice that XRP would be considered a security.”

The enforcement actions cited in the report do not actually support the SEC’s argument in the first place, the Ripple counsel argued, adding that “not one of those cases alleged a violation of Section 5’s registration requirements for a sale of digital assets outside the context of an ICO.”

“The Court should deny the SEC’s request for judicial notice and disregard the SEC’s attempt to rely on disputed facts to foreclose a legally cognizable defense.”

In conclusion, Ripple argues that the court may not properly take judicial notice of the Cornerstone Report, the facts it contains are not undisputed; and if the Court were to consider the cases cited in the report, they support Ripple, not the SEC.

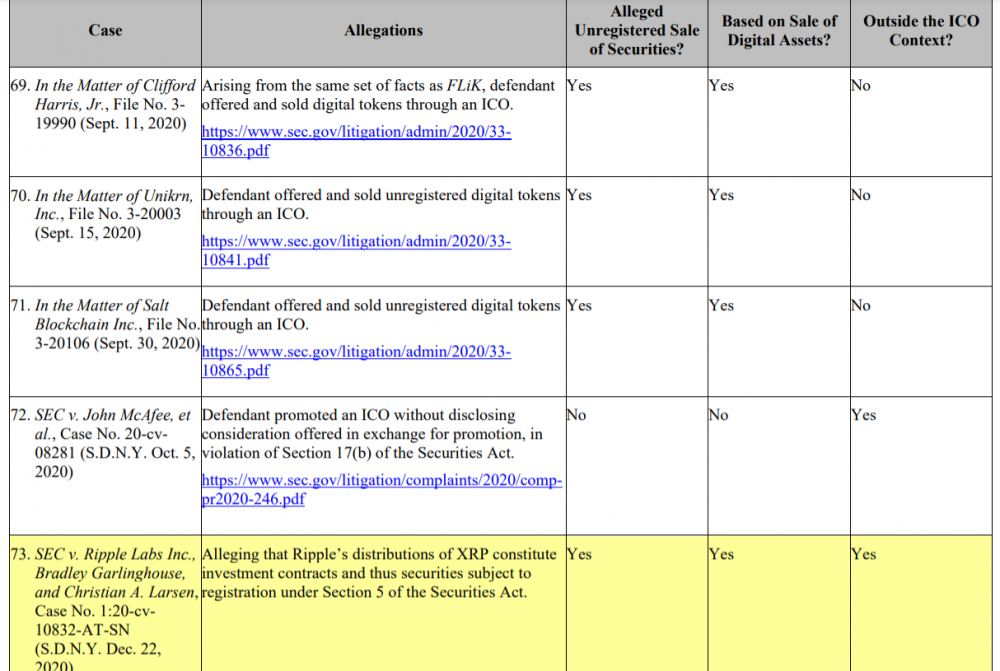

Exhibit A is a list of the 75 cryptocurrency enforcement actions covered by the Cornerstone Report, dividing each action by three categories: “Alleged Unregistered Sale of Securities?“, “Based on Sale of Digital Assets?“, and “Outside the ICO Context?“.

Ripple is the only SEC cryptocurrency litigation that checks all three boxes, thus proving the prior statement “not one of those cases alleged a violation of Section 5’s registration requirements for a sale of digital assets outside the context of an ICO.”