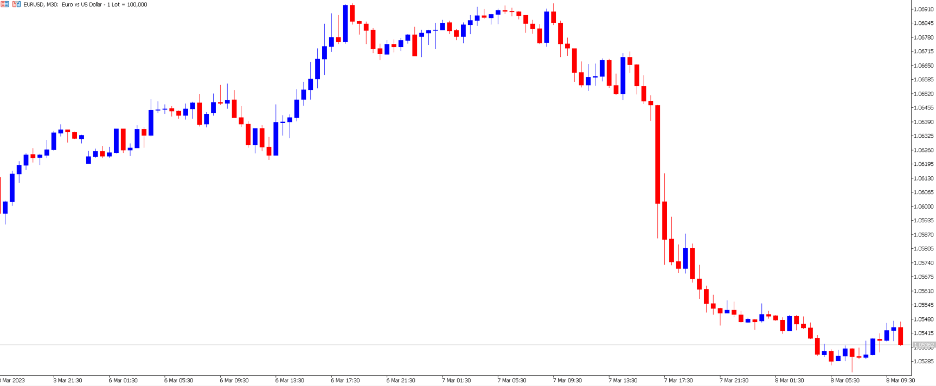

Due to indications of a significant increase in the Fed’s Fund Rate, the EUR/USD experienced its most significant decline in over a month.

The EUR/USD saw its largest decline in over a month as investors no longer can ignore signals that the Fed’s Fund Rate will indeed significantly increase. Many investors believed the Fund Rate would only slightly increase as the rate is already considerably high; however, this is not likely to stop the Fed. The asset over the past 24 hours has declined by 1.25%.

During yesterday’s market analysis, we mentioned the resistance level at 1.0688 and the bearish breakout level at 1.06675. Analysts have been cautious, especially considering the Fed’s ultra-hawkish tone. The bearish breakout level was indeed triggered, giving a signal to traders, and the price eventually declined by 1.10%. Technical analysis still points towards a downward trend in the medium to longer term. Though, investors will be cautious about a retracement and the current loss of momentum. Ideally, traders will be looking for momentum to increase again.

The next interest hike is almost certainly a 50 basis point hike, and the terminal rate will officially increase to 6%. The Chairmen, Mr. Jerome Powell, has advised that the economy, specifically employment, has been more resilient than expected. The chairmen added, “if economic data indicate that faster tightening is warranted, we will be prepared to increase the pace”. Therefore, the decision will again largely depend on this month’s data. However, most economists believe the employment figures and Consumer Price Index will need to be considerably low to persuade members of the FOMC.

Blackrock has been the latest investment bank to comment on the Fed’s latest comments. Rick Rieder from the Global Fixed Income Department advises that the high level of employment will likely keep inflation high and warrant a 6% interest rate for the Fed. A 6% interest rate would significantly change the pricing of the Dollar, but more so, the US stock market.

XAU/USD – Gold Tumbles after Powell’s Testimony

The latest testimony by Mr. Powell also influences the price of XAU/USD and not only currencies and the stock market. The price of Gold has been declining for 2 consecutive trading days and has corrected 4 days of price gains from the past week. In total, the price declined by 1.82% throughout yesterday’s US trading session. The price of gold will continue to be influenced by the price of the US Dollar and the Fed’s monetary policy.

Also, Gold has been unable to act as a safe haven asset and as a hedge against inflation due to the Dollar’s strength and the economy’s resilience. The latest report from the US Commodity Futures Trading Commission indicates that investors believe the price of Gold will decline. The latest report has shown more contacts speculating a decline compared to long positions.

For further signals and information on technical analysis, investors can also view our latest technical analysis video for Gold.

Gold technical analysis video on March 8th

Summary:

- The Fed point towards higher interest rates for longer to tackle inflation and employment.

- The US Dollar Index increases to a 4-month high as the Dollar climbs against all currencies.

- Rick Rieder from Blackrock advises the high level of employment is likely to keep inflation high and would warrant a 6% terminal rate.

- Most economists now believe the Fed will hike 50 basis points at the next interest rates meeting and decision.

Gold significantly declines again as the US Dollar climbs and the economy remains resilient.