CQG has expanded its partnership with Lime Trading in order to integrate its front-end trading platforms into Lime’s back end for trade execution.

The move gives CQG institutional and retail clients the ability to access Lime’s low-latency execution services and gateways to a full range of U.S. exchanges and dark pool venues for equity trading.

The Lime smart router provides fast and advanced trading technology, which results in enhanced “child order” placement, offers comprehensive routing logic between exchanges and dark pools, and includes parallel and sequential venue sweeping.

Executing broker and liquidity-seeking algorithm by Lime Trading

Johan Sandblom, CEO of Lime Trading Corp, commented: “We are excited about the partnership with CQG in which we offer both our services as an executing broker and our sophisticated, liquidity-seeking algorithm – a smart order router that searches for optimal liquidity in a fragmented marketplace. We’re leveraging the technology we built for the demanding low-latency trading community with CQG’s powerful multi-asset trading platform. This is a win for everyone involved – most importantly the clients.”

Alli Brennan, CQG Managing Director, Head of Americas and EMEA, said: “We’re delighted to provide our institutional, proprietary trading and retail clients with this broadened access to the U.S. equities markets through Lime’s high-quality trade execution capabilities and technology. We are seeing a lot of demand for our multi-asset offerings, and this integration gives clients the unique ability to trade and spread futures and equities on a single platform.”

CQG launched multi-asset, multi-broker platform, CQG One

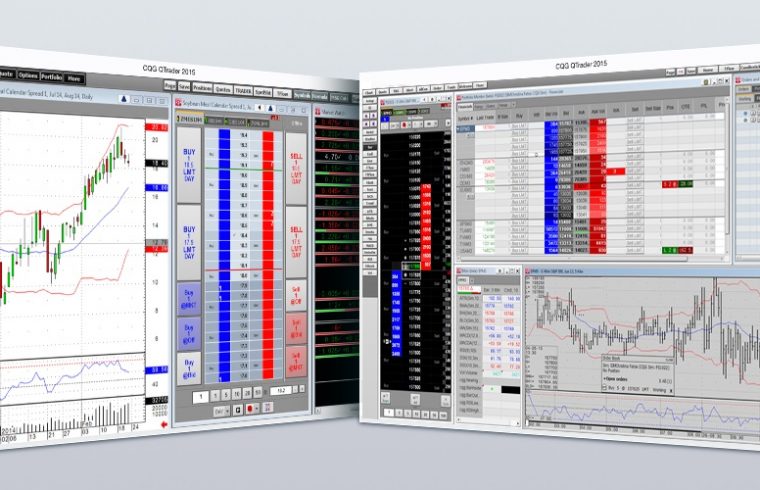

Earlier this year, CQG announced a phased roll-out of its newest trading platform, CQG One. The platform provides access to CQG Algos, new analytics features, custom formulas, price alerts and a spreader.

The new product combines the ease of use of CQG’s retail-oriented terminal with market data, charting, visualization and advanced features of its flagship professional trading platform, CQG Integrated Client.

CQG One caters mainly to professional traders and institutional investors, acting as multi-asset, multi-broker platform that offers a comprehensive set of pre-built algorithmic order types. The Denver-based firm plans to make the new platform available through traders’ futures commission merchants (FCMs) beginning in April, with new functionality added throughout the year.

Among other things, the new platform will include premium functionality such as single-click trade entry, portfolio sharing, window linking, and drag-and-drop tabs. CQG One also offers consolidated real-time and life-of-contract historical market data feeds from more than 75 global sources.