Three leading firms within the digital asset ecosystem, GENTWO, CAT Financial Products, and Aquila, have launched together an independent platform for next generation actively managed investment certificates (AMC Platform).

The new AMC platform enables Swiss asset managers to launch Swiss-compliant AMC (the next generation) with Swiss ISIN code on their own, and then make unlimited use of sophisticated portfolio management services. Individual investment products can be used on the platform as well as complete, bespoke issuance vehicles for the independent development of a complete product range or the qualitative development of an existing AMC offering.

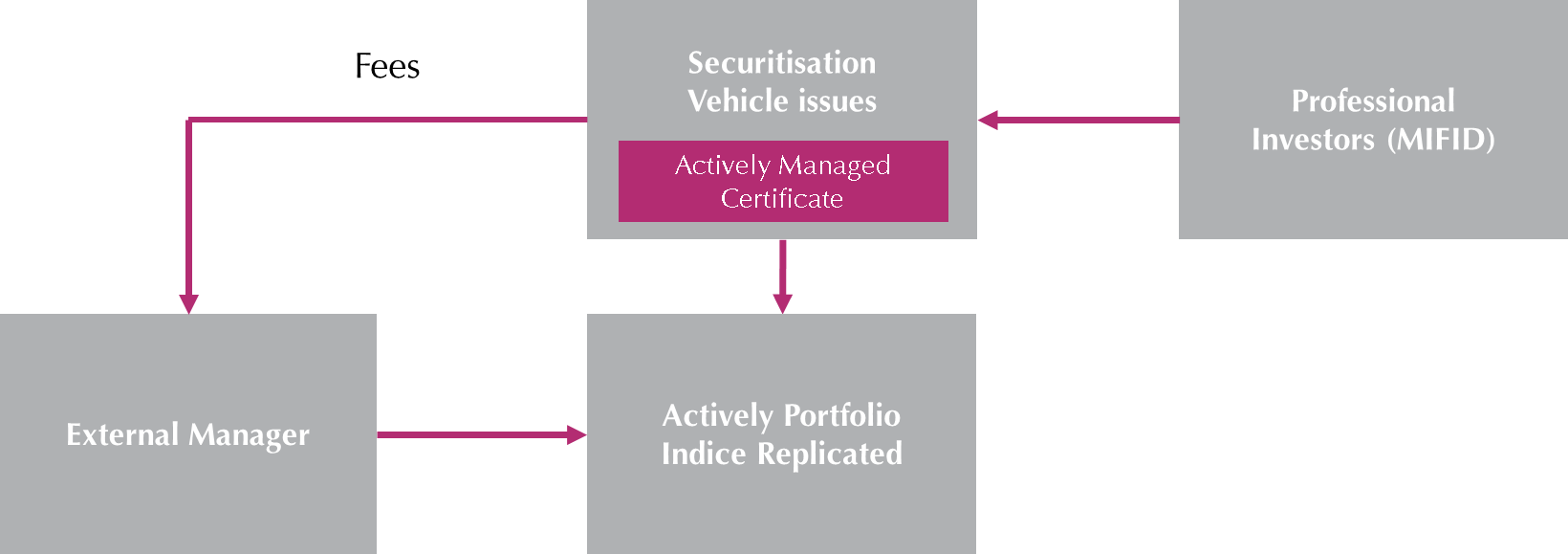

GENTWO, a securitization specialist of next generation financial products, provides unrestricted access to its platform with its innovative next-generation issuance setup. CAT Financial Products (CATFP), a Swiss-based fintech firm specialized in structured products, ensures a smooth interface to the market and its

participants and provides access to its reporting technology. Aquila acts as custodian and clearing bank. Together they are setting a new standard in the Swiss AMC market and add value for Swiss asset managers and their clients.

Asset managers can use Active Managed Certificates (AMC), launched via GENTWO’s off-balance-sheet issuance setup, to implement their portfolio strategies and innovative ideas with particular flexibility and effectiveness.

Self-launched AMCs no longer carry a bank issuer risk and are not otherwise subject to many of the typical restrictions that occur with most traditional issuers of structured products. This allows for genuine issuer management with several other structured products being easily and conveniently integrated in a single AMC, mixed with other assets or instruments such as stocks, bonds or funds.

Asset managers can also reduce their operating expenses and also from the outset avoid tracking errors within their investment strategy as they can manage all accounts with identically managed asset allocation through a single AMC.

Philippe A. Naegeli, Chief Executive Officer of GENTWO, commented: “Our new platform speaks for the functioning of a modern market concept. Pursuing future-oriented innovation strategies alone is becoming rarer today. Modular composite expertise that are purely for a specific purpose are proving to be much more promising. By developing innovation strategies together, financial services providers (including banks) can easily and simply increase the relevance of their existing or new business model without much extra effort. This is the only way to generate growth for the market as a whole.”

Giuliano Glocker, Chief Executive Officer of CAT Financial Products, said: “In July 2018, together with GENTWO, we launched the first global platform for issuing actively managed certificates with one of the worldwide biggest online brokers as custodian and trading agent. We are very pleased to be launching another platform together with GENTWO and also with Aquila as a strong third partner. The outlook on the new opportunities is a further incentive for us. A much broader customer

base can now benefit from our range of services.”

Markus Angst, Managing Director of Aquila Custodian Bank, added: “We are banking partners in this partnership and look forward to successfully working together with GENTWO and CAT Financial Products. Merged core competencies form supply concept along the value chain The scope of the new platform, however, goes beyond the launch of investment products. As a custody and clearing bank, Aquila provides unlimited banking services. Process transparency, risk control, profound specialist knowledge as well as many years of experience provide the best possible conditions for this. CAT Financial Products AG (CATFP) is one of the leading Swiss investment solutions providers in the Structured Products market.